Labour should back a Basic Income

This morning it was announced that Finland is to pilot a Basic Income as part of a far-reaching reform of tax and benefits. During the 2015 election, the Green Party of England and Wales were widely ridiculed for their policy of a ‘Citizens Income’ – more commonly known as a Basic Income. Their ridicule was, in large part, deserved primarily owing to their own obfuscation on the matter and basic failure to mount any defence of it. However, the Basic Income isn’t as absurd an idea as it first appears – which might be why the Finns (not renowned for their radical Communism) – are seriously considering its implementation.

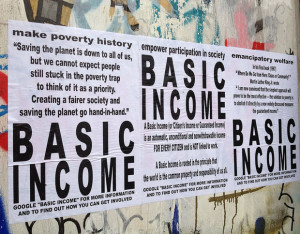

A Basic Income is essentially money given by the state to everyone, regardless of means or need. This was ridiculed as outlandishly expensive in the run up to the 2015 election, however some back-of-the-envelope calculations demonstrate that it could actually be implemented as a relatively modest reallocation, but radical simplification, of the existing tax and benefits systems.

A basic income would simplify the tax and welfare systems, remove the stigma attached to benefits, incentivise work, and redistribute wealth (even if only modestly).

It is a reasonable surmise that most people resident in the United Kingdom will either pay income tax, or else will be living on benefits. Very few people live off savings alone – and you would expect those with sufficient resources to be able to do so to have structured their considerable finances in such away that it generates income.

The purpose of both the personal allowance for Income Tax, as well as of benefits, is to provide people with the basic means of subsistence. This is reflected in their levels. Standard Jobseekers’ Allowance + the average Housing Benefit payment = approximately £8,500, which, when you consider that Council Tax Reduction would also likely be applied, isn’t that far removed from the £10,295 someone earning exactly the personal allowance would take home.

The level at which it was proposed by the Greens – £72 a week – is approximate to Jobseekers’ Allowance. A basic income set at the level of Jobseekers’ Allowance would amount to £3,800. Abolishing the personal allowance and paying everyone, instead, this Basic Income would be equivalent to increasing the personal allowance to £19,000. This, of course, would need to be off-set by a re-calibration of rates and bands. For example – assuming that National Insurance Contributions remain constant – in order to ensure that someone earning the average salary of £26,000 takes home the same amount of money after scrapping the personal allowance and paying him or her a Basic Income of £3,800 on top of their present net salary, a rate of income tax of 26% would have to be applied to their income. Given that the present basic rate of income tax is 20%, this represents a relatively minor shift, approximate to the 25% level that existed in the 90s. In any event, they would still be taking home the exact same amount of money.

Someone earning less – for example £20,000 per year, would be £480 a year better off; someone earning slightly more, for example £30,000 per year, would be £120 a year worse off. Someone earning £7 an hour working 30 hours a week would be about £1,000 better off. This might seem like a lot, but given that that person presently pays almost no tax and is entitled to receive about £2,800 a year in working tax credit – a Basic Income actually looks quite miserly by comparison. Expressed in these terms, a Basic Income begins to look less like an incredibly generous giveaway, and more like the sort of tinkering with rates and bands that is commonplace in every budget – and exactly the sort of shift in the burden of taxation that you would hope that a Labour Government would pursue.

A basic income could remove benefits as a social wedge. Rather than being something that only certain kinds of people get, it would be something that everyone gets. While, of course, there would remain the usual grumblings about people who aren’t working, it is arguable that the basic income would greatly incentivise work.

David Cameron, arguably rightly, identified the “benefits merry-go-round” – whereby people are taxed on their income and then handed it back in the form of benefits. This is certainly the case, as someone earning above the personal allowance but still on a relatively low income will pay tax on their income and then potentially be entitled to a litany of in-work benefits: income support; working tax credits; Local Area Housing Allowance; Council Tax Reduction. Many of these benefits are designed to ensure that working is financially more attractive than not working – however knowing whether or not you will actually be entitled to them feels like guess-work to most of us. The certain knowledge that your basic income continues whether you work or not would greatly incentivise work. No longer would people fear that by going to work they’d be no better off.

Obviously costing such a reorganisation would be a considerable undertaking – and the levels at which a Basic Income would become revenue neutral might vary wildly from those discussed above. But considering that a litany of benefits could either be substantially reduced in scope, or else scrapped altogether – and the associated costs of administering such benefits (we spend £8bn a year simply administering benefits) – it may well transpire that a Basic Income of £72 a week was actually pitched much lower than necessary.

Aug 22, 2015 @ 15:44:16

The £72 a week was not proposed by the Greens, it is what Natalie Bennet was hit with in the infamous interview and failed to defend, but its not the Green Party’s policy. The £72 was an amount suggested by the Citizens Income Trust who have been campaigning for many years for a Citizens/Basic Income.

The Green Party proposal is here if you are interested and is for £80 a week but with additional supplements for single parents and single pensioners. https://policy.greenparty.org.uk/assets/files/Policy%20files/Basic%20Income%20Consultation%20Paper.pdf

Aug 22, 2015 @ 20:45:33

As a founder member of the green Party in 1973, I made sure the Basic, or Citizens’ Income was policy from the outset, but I have been fighing a losing battle ever since to get the leadership or press team to take it seriously. I have written to J. Corbyn, but he didn’t reply.

A word of warning though. One of the advantages as I see it, is that some ‘neo-liberal’ ideas, notably the notion of market forces, stops being oppressive and starts to make sense in certain circumstances. Think Zero hours where you can say ‘sod off’, and not end up at the Food Bank. So neither Corbyn nor the Green Party, which currently insists on trying to occupy the same ecological niche, seem likely to really take up the Basic Income any time soon